Navigating orthodontic care, especially regarding finances, can feel daunting. But fear not! At Loudoun Orthodontics, we’ve teamed up with Virginia’s leading insurance providers to make your path to a dazzling smile both accessible and budget-friendly.

In this guide, we’ll demystify how these partnerships streamline the process, ensuring that your orthodontic journey is as seamless and affordable as possible.

Whether you’re contemplating braces for yourself or your child, gaining insights into how insurance coverage aligns with orthodontic care will empower you to embark on this journey with confidence and clarity.

Table of Contents

What Types of Insurance Does Loudoun Orthodontics Accept?

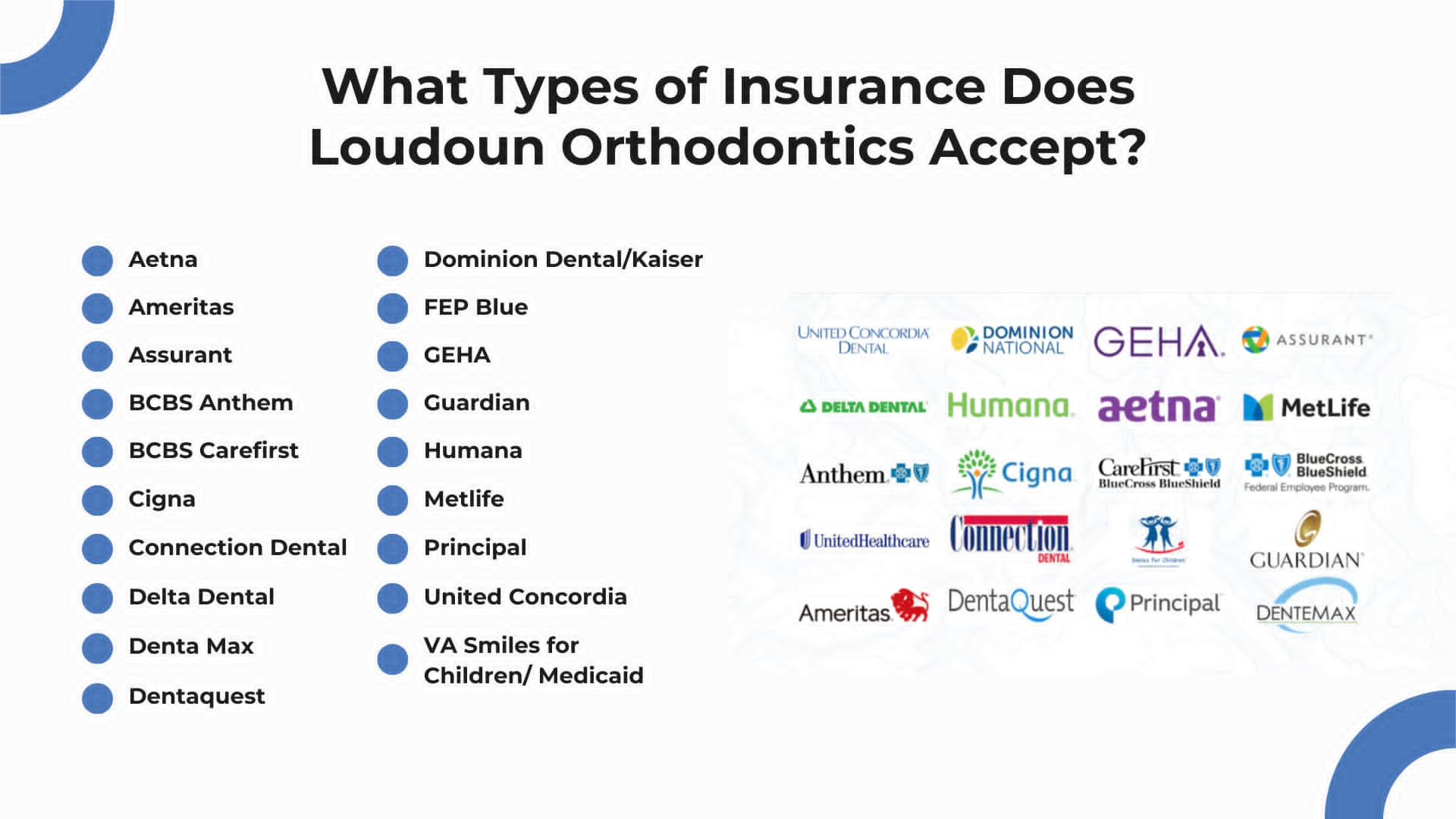

At Loudoun Orthodontics, we believe everyone deserves access to comprehensive orthodontic care without financial strain. That’s why we’re pleased to accept various insurance plans, ensuring our patients can pursue treatments worry-free.

Whether you’re leaning towards traditional metal braces, ceramic braces, lingual braces, or clear aligners, our flexible dental insurance coverage simplifies the braces’ cost management process.

We’re proud to partner with major dental insurance providers like Aetna, Cigna, Delta Dental, and more. Our goal is to make orthodontic treatment accessible to all, so we offer diverse payment plans tailored to fit various budgets and preferences.

For added convenience, we handle the insurance claim submission process and accept available benefits directly, leaving you responsible only for the uncovered portion of treatment costs.

Does Loudoun Orthodontics Work with Specific Virginia Insurance Providers?

Loudoun Orthodontics is committed to providing accessible orthodontic care by partnering with specific Virginia insurance providers.

Our network includes esteemed health insurance companies like BCBS Anthem, BCBS Carefirst, United Concordia, and VA Smiles for Children/Medicaid. Through these collaborations, we strive to maximize patient benefits and minimize out-of-pocket expenses and hidden costs.

This partnership underscores our dedication to serving the community’s needs, including exceptional support for educators and military personnel.

Patients within our insurance network typically receive a contractual discount on treatment costs and insurance contributions toward orthodontic care. Orthodontic insurance generally covers $1000 to $2000 over the treatment period at a 50% rate, representing a once-in-a-lifetime benefit. Therefore, maintaining continuity with your insurance provider throughout treatment helps avoid unexpected additional costs due to insurance changes.

What Part of Orthodontic Care Is Typically Covered by Virginia Insurance Providers?

In Northern Virginia, dental insurance plans frequently encompass coverage for diverse orthodontic treatments, alleviating the financial strain for individuals and families seeking a more aligned smile. Typically, these plans extend coverage for traditional braces, spanning metal, ceramic, and lingual variations, alongside discreet alternatives such as clear aligners.

Insurance coverage for orthodontic treatment varies widely among health insurance companies and specific dental plans. Typically, these plans cover a percentage of the treatment costs or offer a fixed dollar amount. This coverage usually encompasses initial consultations, routine adjustments, and certain necessary procedures. However, limitations and conditions, such as lifetime maximums, restrict the total amount an insurance plan will contribute toward orthodontic care.

Orthodontic insurance benefits often extend to cover other dental procedures necessary to support the orthodontic treatment, such as addressing gum disease or tooth decay. These services are crucial for maintaining overall oral health throughout the alignment process. However, specific procedures, like cleft lip corrections or more complex dental and orthodontic issues, may require special provisions or incur additional out-of-pocket expenses.

Before beginning treatment, you must have thorough discussions with your orthodontist and insurance provider to fully understand the specifics of your coverage. This includes clarifying potential hidden costs or additional expenses beyond the initial estimate. By preparing in advance, you can effectively manage your finances while pursuing your orthodontic treatment goals.

How Can I Maximize My Orthodontic Coverage with Virginia Healthy Smiles at Loudoun Orthodontics?

Maximizing your orthodontic coverage with Virginia Healthy Smiles at Loudoun Orthodontics is key to ensuring your treatment remains as affordable as possible.

What Steps Should I Take to Ensure Full Insurance Coverage for My Treatment?

- Understand Your Benefits: Begin by thoroughly familiarizing yourself with the coverage provided by your dental insurance plan. This entails determining whether your plan extends coverage to metal, ceramic, or lingual braces. Take note of important details such as covered percentages, out-of-pocket maximums, lifetime maximums, and any limitations or exclusions related to orthodontic care.

- Pre-Treatment Estimate: Before commencing your orthodontic treatment, requesting a pre-treatment estimate is prudent. This can be facilitated through Loudoun Orthodontics, where we submit a comprehensive treatment plan to your insurance provider. This allows for a thorough breakdown of the expenses they will cover and what portion will be your financial responsibility.

- Utilize Flexible Payment Plans: At Loudoun Orthodontics, we understand that managing orthodontic costs can be a concern, so we provide flexible payment plans and 0% interest options. These arrangements allow you to distribute any expenses not covered by insurance over a period, making payments more manageable and aligning with your family’s budget.

- Regular Communication with Your Insurer: It is critical to stay in touch with your insurance provider during your treatment journey. This helps you stay informed about any updates or changes in your coverage, allowing you to adjust your payment plans accordingly and avoid any surprises down the line.

- Annual Review: It’s essential to review your insurance plan annually to stay updated on any changes or new benefits that could benefit you. This includes checking for increased coverage for dental procedures or including new technologies that your plan may cover. Keeping informed ensures you maximize your insurance benefits and save on out-of-pocket expenses.

- Direct Billing: Direct billing is a convenient option that simplifies the process by reducing the upfront costs you need to pay out-of-pocket. It also ensures that claims are submitted correctly and efficiently, saving you time and hassle.

What Happens if I Lose My Insurance Mid-Treatment?

Losing your dental insurance mid-treatment can be stressful, especially when undergoing a lengthy process like orthodontic treatment.

However, there are steps you can take to manage the situation effectively:

- Contact your orthodontist’s office immediately to inform them of your situation. Loudoun Orthodontics understands the challenges of unexpected changes in insurance coverage. That’s why we offer flexible payment plans to accommodate shifts in your financial situation. Whether you’re undergoing treatment with metal braces, ceramic braces, or clear aligners, we’re here to ensure your orthodontic care can continue smoothly.

- Exploring alternative financing options in the event of lost insurance coverage is a proactive step toward managing out-of-pocket expenses and ensuring your orthodontic treatment stays on track. At Loudoun Orthodontics, we can discuss various options with you, such as flexible payment plans or third-party financing solutions. By understanding the total cost of your treatment and any additional treatments that may be needed, we can work together to find a solution that fits your budget and keeps you on the path to achieving a beautiful smile.

- If you lose your insurance coverage due to circumstances beyond your control, such as changes in your employer’s benefits, some insurance companies offer a “treatment in progress” benefit. This benefit allows you to continue your orthodontic treatment without interruption, with the new insurance coverage picking up where the previous coverage left off. It’s essential to inquire about this option with your insurance provider to understand if you’re eligible and how it applies to your specific situation.

How Does Dual Insurance Work in Orthodontic Treatment?

Having dual dental insurance can significantly reduce your out-of-pocket expenses for orthodontic treatment. When you have two insurance plans, they work together to maximize your coverage, minimizing the amount you need to pay.

One insurance plan is typically considered the primary insurer and covers some treatment costs. The secondary insurance plan then kicks in to cover some of the remaining expenses up to the total cost of the treatment.

To ensure smooth coordination of dual insurance coverage at Loudoun Orthodontics, it’s essential to provide information about both insurance plans. Our office staff will then work with both insurance companies to determine how benefits are coordinated. This usually involves submitting claims to both insurers, starting with the primary plan.

By managing dual insurance coverage effectively, you can maximize your benefits and reduce your financial burden during orthodontic treatment.

Coordination of Benefits (COB) varies depending on the specific rules of each insurance plan, and having dual coverage may not always fully cover the costs of orthodontic treatment, such as braces or other procedures.

It’s crucial to understand the details and limitations of your dental insurance plans. While it’s commonly assumed that having dual insurance means you’ll receive the orthodontic maximum from both plans, this isn’t always the case. The extent of coverage from the secondary plan depends on how it’s structured and negotiated.

Sometimes, the secondary plan may not contribute further if the primary insurance already covers the maximum amount. Understanding these details can help you maximize your benefits and reduce your treatment costs effectively.

Ready for a Brighter Smile? Let’s Get Started at Loudoun Orthodontics!

Contact Loudoun Orthodontics if orthodontic care is the solution to your dental woes. Whether you want to learn more about the benefits of orthodontic care or have questions about the process, use our live chat or call (703) 858-0303 or message us through our Contact Us page to connect with our friendly staff today and book a complimentary consultation!

Our office, located at 19465 Deerfield Ave. Suite 304, Leesburg, VA 20176, proudly serves the Loudoun County. If you’re residing in Ashburn, Leesburg, or Sterling and are looking for one of the best orthodontists in Northern Virginia, don’t hesitate to visit our office!

We also invite you to keep up with our blog to get answers to many of the frequently asked questions about maintaining your perfect smile, and follow us on Facebook and Instagram to become a part of our smiling community!